Over the past few months, a pattern I’ve been tracking for a while began to crystalise with increasing clarity. This publication is not a victory lap but an opportunity to check the pulse of the Yen Carry Trade dynamic that I’ve long articulated. The effects of the USDJPY currency pair on the rhythm and flow of the market were already self evident to me, hopefully now it’s starting to become clear to you too. The Dollar vs the Yen is no longer just a background metric, instead, it’s the metronome of global liquidity itself.

While risk assets have been grinding higher, the USDJPY has been tussling against inertia. Both bulls and bears have been frustrated with two fake-outs in either direction. Now everyone is out of position, it’s time for the real move. The volatility, as seen by the Bollinger Band Width has compressed into the apex of the triangle and is now expanding. I suspect this breakout will be a powerful one.

After a few failed attempts, the DXY looks ready to complete the wave 2 retracement towards the golden pocket. Not only is there a strong daily bullish divergence that has formed but the RSI is also breaking above the downward trend line, indicating a potential shift in momentum. With high levels of short interest on the Dollar, this move could be explosive.

NASDAQ AND NIKKEI REVIEW

In my first publication, I posited that the Nasdaq was likely to push higher and that’s exactly what we’ve seen. However, it has turned out even more bullish than I imagined because it has now evolved into an extended 5th wave, which is indicative of a blow-off top structure. I expect this final move to be almost vertical, climaxing around the same time that the USDJPY is forming a local top.

Following in the same vein, the Nikkei has also developed an extended 5th wave. The bullish trend in the Nasdaq and Nikkei over recent weeks was hinting that the USDJPY was going to breakout. It’s almost impossible for the indices to move higher if there were to be Yen strength on the horizon. Therefore it makes sense that the USDJPY currency pair will move sharply higher, coinciding with a powerful climax for both the US and Japanese stock markets.

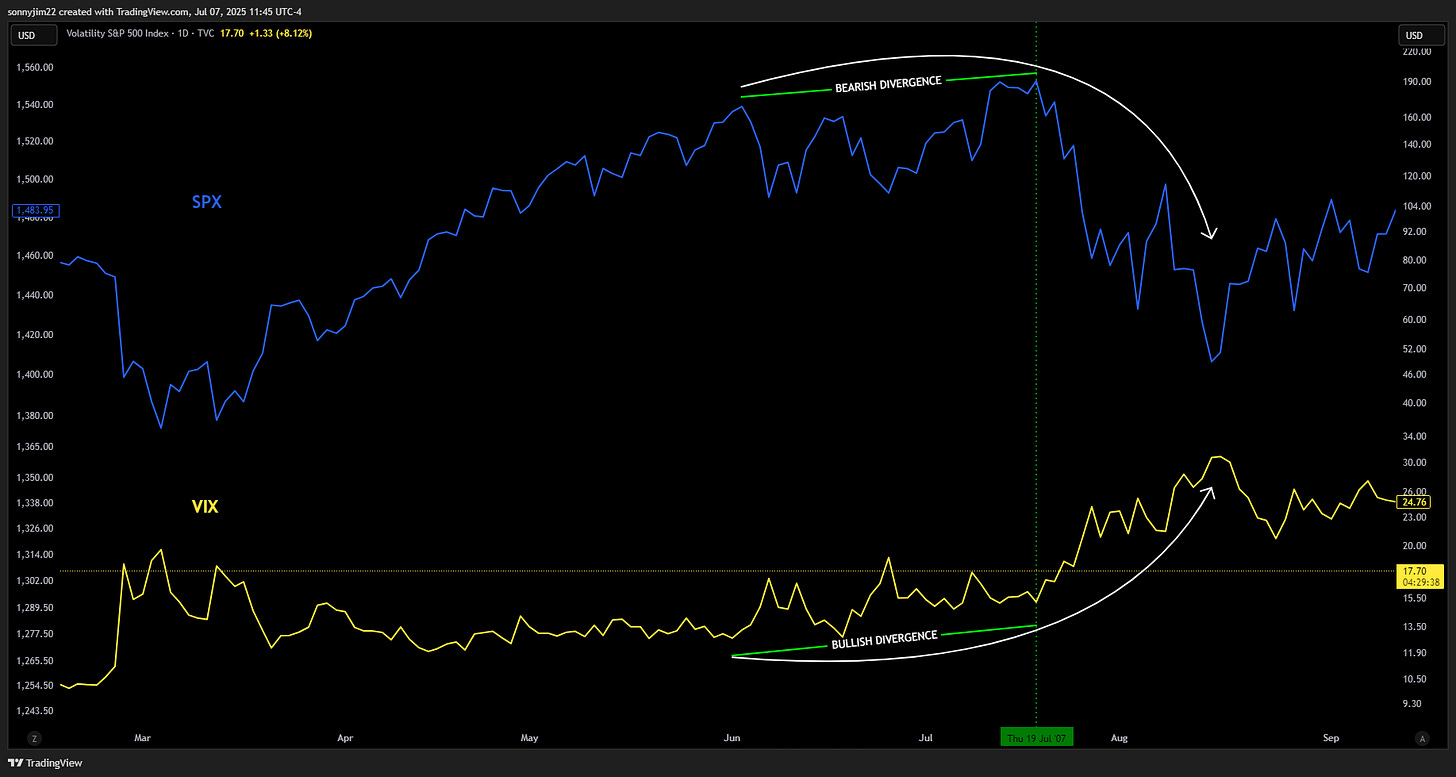

THE VIX DIVERGENCE ECHO

Quite remarkably, as the S&P continues to make all time highs, the VIX is still languishing around 17. The VIX is a potential canary in the coal mine, signaling latent volatility coiling beneath the surface with a daily bullish divergence on the RSI. I wouldn’t be surprised to see another lower low on the VIX this week as the broader market finds a top, exaggerating the bullish divergence further.

Could this setup be an echo of July 2007… As we can see, it’s a strikingly similar situation with a divergence forming between the SPX and the VIX. The divergence eventually manifested in disaster later in August – will this time be different? Given the USDJPY is breaking out, I suspect there is one last hurrah for bulls that will force bears to finally capitulate, just at the worst time! This would be a perfect flush of sentiment, forcing bears to accept defeat, right when they should be taking the opposite side of the trade.

On the weekly time frame, there is currently a large divergence building between the SPX and the VIX. This is a massive red flag!

BITCOIN AS A BETA INDICATOR

With the USDJPY stagnant over recent weeks, it speaks to what I’ve been suggesting in my publications; as long as the Yen is not strengthening, there is breathing room for risk assets like Bitcoin to trend higher. The Yen weakness has allowed liquidity to flow, finding a home in high beta assets like Bitcoin which has completed an impulse during that time. The wave 2 correction terminated at the 0.236 Fibonacci retracement which is a shallow pullback, indicative of an underlying strength.

The fact that Bitcoin recently broke out and completed a successful retest of the breakout, at the same time that the USDJPY is breaking out, doesn’t seem like a coincidence to me!

Bitcoin Dominance in yellow continues to beautifully map onto the inverted DXY chart in blue. Both are showing signs of exhaustion and look over extended. Their reversion to the mean could be a powerful reversal that most people aren’t expecting. However, Altcoin out performance relative to bitcoin shouldn’t be a surprise if we do end up seeing the DXY move higher.

THE INVERSE YEN CARRY TRADE STRATEGY

Phase 1 – Risk On

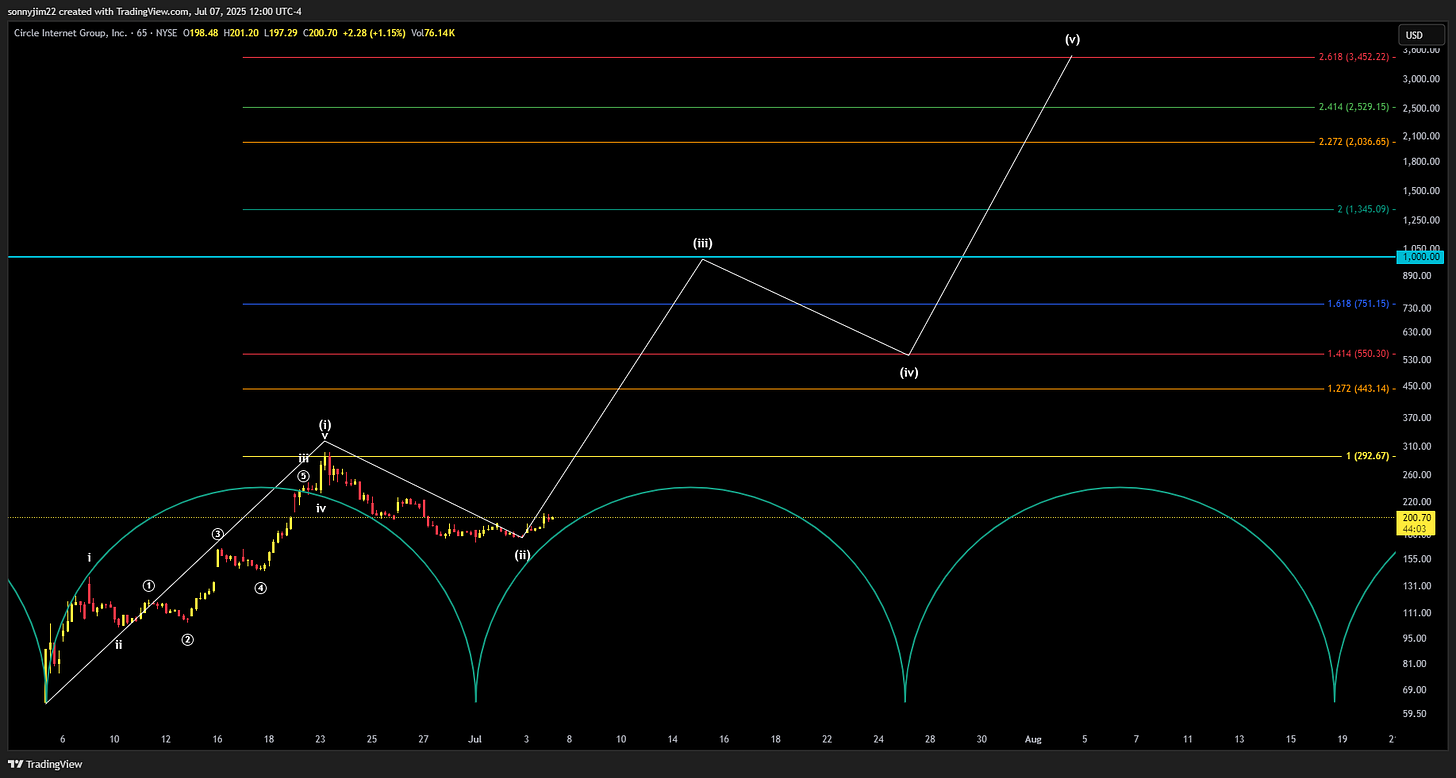

Over the last couple of weeks, I’ve begun by building leveraged long positions in CLSK & CRCL. Both of these positions were communicated in real time via my Slice profile, with clear entry and invalidation levels. So far, neither position has been stopped out and both are currently in the green.

Phase 2 – Risk Off

I want to be able to stay in the CLSK and CRCL trades for as long as possible, whilst also protecting myself from downside volatility.

Therefore, the next step will be to identify when USDJPY is forming a local top. This will be a signal that danger is on the horizon for risk assets. Using my margin, I’ll build a short position in USDJPY so that I can hedge my long positions, protecting me from a correction as the Yen strengthens later in July.

USDJPY looks to be forming a running flat as part of the wave 2 correction. Once this is complete, it will begin a powerful wave 3 impulse down as the Yen Carry Trade unwinds.

Conclusion

USDJPY is the market thermometer of risk which is exactly why I’m using it as a hedging vehicle. The rhythm and pulse of the market dances to the tune of this currency pair due to the Yen Carry Trade dynamic and I seek to take full advantage of that. Shorting the USDJPY, rather than my risk on assets like CLSK and CRCL, is a much more effective way to hedge because I’m front running the USDJPY short squeeze.

Deleveraging happens fast and violently. It becomes a self-fulfilling feedback loop, causing a cascade of liquidations that only algorithms have time to react to. Through the Inverse Yen Carry Trade strategy, I’m reflexively capturing the Yen unwind in a way that’s likely to overcompensate me during sharp market corrections. By tracking the USDJPY in such a way and utilizing it as a hedge, I will compound my profits regardless of the market’s direction and risk appetite.

As the Yen inhales, liquidity contracts. As it exhales, it floods the system. Those attuned to its cadence are not reacting, they’re dancing to its rhythm. To ignore its pulse is to trade blindfolded. The Yen doesn’t shout, it whispers, and in those whispers lies the turning of the tide. The risk is not in volatility, it’s in deafness. For those who hear the song of flow beneath the noise of market gyrations, it’s possible to swim with the tide. In that way, the Yen is not a currency, it’s a clock, and it’s our job to feel the beat of it’s rhythm.

The content provided in this newsletter is for educational and informational purposes only and should not be construed as financial advice. I do not endorse or recommend any specific investments, securities, or strategies. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions. Your use of this information is at your own risk, and I’m not liable for any losses or damages arising from your reliance on it.

Cool stuff 😎

Thank you Sonny. Great article. I’ve only just begun studying the yen carry trade and how it affects BTC. 😎🫡